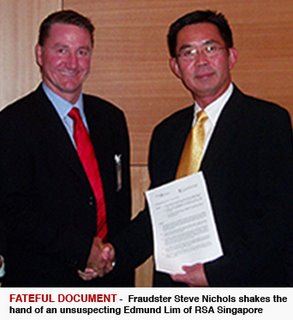

The tie-up is allegedly to sell Interglobal Insurance to unsuspecting expatriates residing in Singapore and China.

Apparently the pursuit of potential income has superseded the insurer's obligation to its shareholders and the public to do business only with ethical parties. Either that or RSA's due diligence process has failed miserably. What is unknown at this point is how RSA intends to explain this to the Chinese and Singaporean insurance regulators, and why they are putting their entire business operation in those jurisdictions at risk for the sake of a relatively small amount of potential income.

Comments from insurance regulators will be posted here as they become available.

More Details: Click Here