Insurance Australia Group New Zealand’s July, 2004 acquisition of 50.1% of the Mike Henry Travel Insurance Limited business seemed to be an insignificant event at the time. The annual net income for the NZ provider of travel insurance isn’t even a rounding error for the Australian insurance giant. It seemed so insignificant, in fact, that the transaction was referred to in an Insurance Australia Group press release at the time as “a small acquisition in New Zealand” and “neither the acquisition nor the premiums are significant to the results or financial position of IAG.”

Insurance Australia Group New Zealand’s July, 2004 acquisition of 50.1% of the Mike Henry Travel Insurance Limited business seemed to be an insignificant event at the time. The annual net income for the NZ provider of travel insurance isn’t even a rounding error for the Australian insurance giant. It seemed so insignificant, in fact, that the transaction was referred to in an Insurance Australia Group press release at the time as “a small acquisition in New Zealand” and “neither the acquisition nor the premiums are significant to the results or financial position of IAG.”A seemingly insignificant event like this one can often lead to serious trouble.

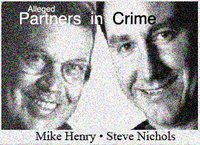

Compelling evidence that Michael Paul “Mike” Henry, the 60-year-old founder of Mike Henry Travel Insurance Limited, and Steven Murray Nichols, managing director of Mike Henry Travel Insurance Limited, have allegedly defrauded a number of former business associates, has made the acquisition appear to have been a serious mistake. Furthermore, Mike Henry has been linked to organised crime, through a long-established business partnership of some 8 years, with a biker gang member and drug trafficker who was convicted and sentenced to a 12-year prison term in May, 2005, along with Mike Henry’s daughter, Deborah Anne Henry, who was convicted and handed a 2-year sentence for drug crimes, (see “Business Partner, Daughter of Mike Henry Travel Insurance Limited Founder Convicted of Drug Trafficking, Sentenced” elsewhere in this blog).

Compelling evidence that Michael Paul “Mike” Henry, the 60-year-old founder of Mike Henry Travel Insurance Limited, and Steven Murray Nichols, managing director of Mike Henry Travel Insurance Limited, have allegedly defrauded a number of former business associates, has made the acquisition appear to have been a serious mistake. Furthermore, Mike Henry has been linked to organised crime, through a long-established business partnership of some 8 years, with a biker gang member and drug trafficker who was convicted and sentenced to a 12-year prison term in May, 2005, along with Mike Henry’s daughter, Deborah Anne Henry, who was convicted and handed a 2-year sentence for drug crimes, (see “Business Partner, Daughter of Mike Henry Travel Insurance Limited Founder Convicted of Drug Trafficking, Sentenced” elsewhere in this blog).But that isn’t the worst of it.

It has come to light that Insurance Australia Group New Zealand, as well as the law firm which was performing the due diligence, were warned specifically of the existence of evidence of crimes allegedly committed by Mike Henry, just days before the deal was to close, but that this notification was not acted upon. Why such important information was not acted upon is unknown at this point, but it looks like what might have been a cover-up appears to have possibly taken place.

The law firm in question is none other than the law firm featured in the book "Thirty Pieces of Silver", which exposed the darker side of the legal profession, in some ways not unlike the best selling book "The Firm", which was made into a popular movie starring Tom Cruise. The idea that IAG NZ used such a notorious law firm to perform due diligence on unsavory characters like Mike Henry and Steve Nichols is almost surreal, especially in light of the fact that the law firm, as well as the dealmakers at IAG NZ, ignored warnings of illicit activities on the part of Messrs. Henry and Nichols. This appears to be a clear breach of fiduciary duties.

The fact that Insurance Australia Group seems willing to look the other way and do business with Mike Henry, a man who does not share Insurance Australia Group’s values, is improper and calls into question Insurance Australia Group’s judgment.

In addition to Mike Henry Travel Insurance Limited, Insurance Australia Group and Mike Henry have for some years jointly owned First Rescue and Assistance Limited (First Assistance), a call centre based in Auckland, NZ. To be this deeply involved with a business partner for years and suddenly find out he's a filthy rat is understandably a difficult situation to extract oneself from without significant embarrassment.

In addition to Mike Henry Travel Insurance Limited, Insurance Australia Group and Mike Henry have for some years jointly owned First Rescue and Assistance Limited (First Assistance), a call centre based in Auckland, NZ. To be this deeply involved with a business partner for years and suddenly find out he's a filthy rat is understandably a difficult situation to extract oneself from without significant embarrassment.If all that wasn’t bad enough, there’s more. Resulting from its 2005 acquisition of Royal & Sun Alliance Insurance Thailand, Insurance Australia Group NZ inherited still another business tie-up with Mike Henry in Thailand, an expatriate medical insurance program, which now trades under the brand name "NZI" in Thailand, part of Interglobal Limited, a provider of expatriate health insurance illicitly controlled by Mike Henry. The founder of the Interglobal (formerly Global Healthcare) business and a number of other persons have provided sworn statements and documents to the Serious Fraud Office in New Zealand, in which they detail dozens of individual allegations of fraud, conspiracy, duress, embezzlement, theft of millions of dollars, and tax fraud, among other criminal acts, on the part of Mike Henry, and Steven M. Nichols, in connection with their seizure of control of the Interglobal (formerly Global Healthcare) business, while its founder was recovering from a serious traffic accident. (see “Financial Trouble at Interglobal” elsewhere in this blog)

So why is Insurance Australia Group, a large, reputable company in an industry where honesty and integrity are the very core of the business, risking their good name by "making small acquisitions", that are "not significant" to IAG's financial position, from the likes of Mike Henry and Steve Nichols, and apparently standing by such corrupt persons in the face of overwhelming evidence? Even more significantly, by making misjudgements such as this, and leaving them uncorrected, isn’t Insurance Australia Group risking the ire of shareholders, which conceivably could bring all of IAG’s recent and future acquisitions under the microscope, and put the brakes on Insurance Australia Group's current acquisition tear?

As IAG CEO Michael Hawker stated in an interview with CEO Forum, "From a credibility point of view, we had to lift our game".

What better way to lift IAG's game than to choose its business partners more carefully and weed out those who are subsequently found to be not playing the game by the rules, even if it means admitting a mistake or two along the way.

What better way to lift IAG's game than to choose its business partners more carefully and weed out those who are subsequently found to be not playing the game by the rules, even if it means admitting a mistake or two along the way.Given the fact that insurance companies are, by nature, not known for ranking high on the public's most admired list, the respect the public has for IAG could suddenly turn to scorn, if this situation is not swiftly and decisively addressed.

And if recent history is any guide, a cover-up can turn seemingly minor missteps into a full-blown scandal, and even bring down a company. The parallels with Arthur Anderson are a chilling reminder. Insurance Australia Group is a public company with a lot at stake, and IAG CEO Michael Hawker needs to find out what went wrong in the New Zealand subsidiary and deal with it, before this small acquisition turns into a major disaster for the company.

Alternatively, if IAG was to make a public statement of disassociation with Mike Henry and cancel all business ties, even without going into the details, IAG could turn this potentially explosive situation into a positive one, and even enhance its already stellar reputation with the public and shareholders.

• • • • •

This story was prepared in part with information from the following sources:

CEO Forum

http://www.ceoforum.com.au/200309_ceodialogue.cfm

No comments:

Post a Comment